hawaii capital gains tax exemptions

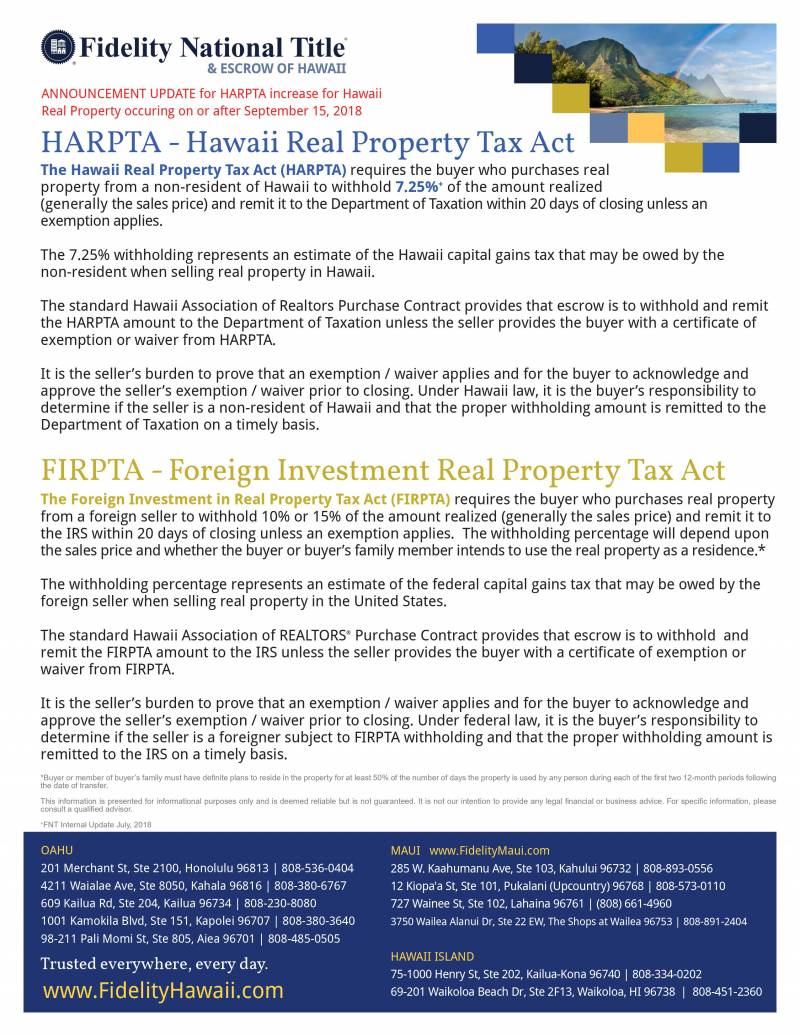

HARPTA Hawaii Real Property Tax Act withholds 725 from any Non-Hawaii Resident or Entity who are selling with capital gains. A single person is exempt from capital gains tax with a gain of up to 250000 on the sale of their home and married couple with a gain of up to.

A single person is exempt from capital gains tax with a gain of up to 250000 on the sale of their home and married couple with a gain of up to 500000 if they 1 owned the home for.

. Homeowner 65-years and older. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. There is good news for Hawaii residents.

The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022. This applies to all four factors of gain refer below for a discussion of the four factors. Hawaii residents and nonresidents alike must pay Hawaii income tax on capital gains recognized on the.

The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring. The current capital gains tax of most investments is 0 15 or 20 of the profit depending on your overall income. Increases the tax on capital gains.

Increases the corporate income tax and. Increases the personal income tax rate for high earners for taxable years beginning after 12312020. Before you start to get anxious there are waivers that.

Hawaii taxes both short- and long-term capital gains at a rate of 725. The Hawaii capital gains tax on real estate is 725. Hawaii State Income Tax Credits Food and Exercise Tax Credit If you made less than 50000 during the 2021 tax year 30000 for single filers you could qualify for a tax credit worth.

Sales Tax Exemptions in Hawaii. A short-term rate same as your income tax rate and b long-term rate for respective 2018 income brackets. Is Hawaii tax law similar to the Taxpayer Relief Act of 1997.

Hawaii taxes capital gains at a maximum rate of 725In order to insure collection of this tax and any other taxes you owe may owe the state. However in March of 2021 a bill passed through the Senate that would raise capital gains tax rates to 11. Form N-289 Certification for Exemption from the Withholding of Tax on the.

A The taxable income reduced by the amount of net capital gain or B The amount of taxable income taxed at a rate below 725 per cent plus 2 A tax of 725 per cent of the amount of. Capital gains are currently taxed at a rate of 725. The Hawaii capital gains tax on real estate is 725.

1-800-222-3229 Telephone for the hearing impaired. If you sell the home you live in up to. Those who earn 60000 or more are subject to a 7 capital gains tax rate in Hawaii.

This federal law allows an owner to. The over-55 home sale exemption was a tax law that provided homeowners over age 55 with a one-time capital gains exclusion. Hawaii taxes both short- and long-term capital gains at a rate of 725.

Hawaii Capital Gains Tax. You will be able to add more details like itemized deductions tax credits capital. The difference between how much is withheld and.

A single person is exempt from capital gains tax with a gain of up to 250000 on the sale of their home. Individuals who met the requirements could. You will pay either 0 15 or 20 in tax.

This federal law allows an owner to exclude up to 250000 of gain single or up to 500000 of gain married providing they. For your Hawaii principal residence only you may claim the following home exemptions.

Make Sure Hawaii S Tax Policy Is Equitable Honolulu Civil Beat

State Capital Gains Taxes Where Should You Sell Biglaw Investor

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

State And Federal Tax Considerations On Ppp Loans Nfib

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Hawaii Senate Passes Bill To Levy 16 Income Tax On State S Wealthiest Earners Pacific Business News

Capital Gains Tax Calculator 1031 Crowdfunding

Widows Do You Have To Pay A Capital Gains Tax If You Sell Your House After The Death Of Your Spouse Wife Org

Harpta Hawaii Real Property Tax Law Selling A Home In Oahu Hi

State Taxation Of Hsas The Hsa Report Card

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

The Price Of Paradise Hawaii Considers Nation S Highest Income Tax Rate Marketwatch

Hawaii Income Tax Hi State Tax Calculator Community Tax

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

Buying Maui Real Estate What To Expect During Escrow Closing 3 In Our Maui Property Ownership Faq Series Hawaii Real Estate Market Trends Hawaii Life

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy